Comprehending Home Loan Calculators: How They Can Aid in your house Acquiring Process

Comprehending Home Loan Calculators: How They Can Aid in your house Acquiring Process

Blog Article

Smart Loan Calculator Option: Simplifying Your Economic Estimations

Imagine a device that not only streamlines complicated car loan estimations however likewise gives real-time insights right into your monetary commitments. The smart finance calculator remedy is created to enhance your economic computations, using a seamless way to examine and plan your finances.

Benefits of Smart Lending Calculator

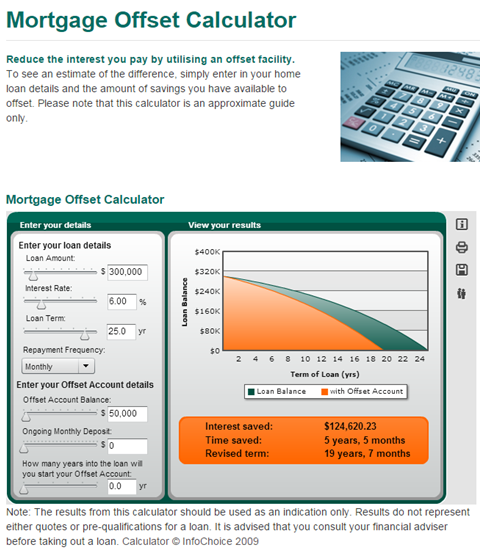

When analyzing financial choices, the benefits of utilizing a clever finance calculator become obvious in promoting educated decision-making. By inputting variables such as finance amount, rate of interest rate, and term size, individuals can evaluate different situations to pick the most cost-effective option tailored to their monetary scenario.

In addition, wise financing calculators provide transparency by breaking down the total price of borrowing, consisting of rate of interest payments and any type of additional fees. This transparency equips users to recognize the financial effects of taking out a financing, allowing them to make audio monetary decisions. Additionally, these tools can save time by supplying immediate computations, getting rid of the need for complicated spread sheets or hands-on computations.

Attributes of the Tool

The device integrates an user-friendly user interface developed to streamline the process of inputting and analyzing car loan data effectively. Customers can conveniently input variables such as finance amount, rate of interest, and lending term, enabling for quick computations of monthly payments and complete passion over the car loan term. The tool additionally supplies the versatility to adjust these variables to see just how changes affect the general financing terms, empowering customers to make informed economic decisions.

Furthermore, the clever lending calculator supplies a break down of each monthly payment, showing the part that goes towards the major quantity and the passion. This attribute assists users envision how their settlements add to repaying the lending with time. Users can create comprehensive amortization schedules, which describe the payment timetable and interest paid each month, assisting in long-term economic preparation.

Exactly How to Use the Calculator

In navigating the loan calculator effectively, individuals can conveniently take advantage of the user-friendly interface to input vital variables and create valuable economic understandings. To begin making use of the calculator, customers ought to initially input the financing amount they are thinking about. This is usually the total quantity of money borrowed from a lender. Next off, individuals require to enter the car loan term, which describes the period over which the finance will certainly be repaid. Following this, the interest rate need to be inputted, as this considerably influences the general cost of the lending. Individuals can likewise define the settlement frequency, whether it's month-to-month, quarterly, or annually, to line up with their financial planning. Once all needed fields are completed, pressing the discover here 'Compute' switch will swiftly process the info and give crucial information such as the regular monthly repayment amount, total passion payable, and total funding price. By adhering to these easy actions, users can efficiently utilize the lending calculator to make enlightened financial decisions.

Advantages of Automated Calculations

Automated computations simplify financial processes by quickly and precisely calculating complicated numbers. Manual computations are prone to errors, which can have substantial ramifications for monetary choices.

Furthermore, automated calculations conserve time and rise effectiveness. Complicated financial calculations that would normally take a significant quantity of time to complete by hand can be performed in a fraction of the moment with automated tools. This permits financial experts to concentrate on examining the outcomes and making notified choices instead than investing hours on calculation.

In addition, automated estimations provide uniformity in results. The formulas made use of in these devices adhere to the very same reasoning whenever, ensuring that the computations are consistent and dependable. This consistency is crucial for contrasting various monetary circumstances and making audio economic options based upon exact information. Generally, the advantages of automated estimations in enhancing financial procedures are undeniable, providing enhanced accuracy, effectiveness, and consistency in complicated economic computations.

Enhancing Financial Planning

Enhancing monetary planning entails leveraging innovative tools and approaches to maximize fiscal decision-making procedures. By making use of advanced economic planning software application and services, people and calculators can obtain deeper insights right into their monetary health and wellness, set practical objectives, and develop actionable plans to attain them. These devices can analyze different economic situations, project future Website outcomes, and give referrals for reliable wide range monitoring and threat mitigation.

Moreover, improving financial preparation encompasses integrating automation and fabricated knowledge right into the process. Automation can improve routine financial jobs, such as budgeting, expenditure tracking, and financial investment surveillance, maximizing time for critical decision-making and evaluation. AI-powered tools can use customized financial advice, determine trends, and suggest optimal financial investment possibilities based upon private threat accounts and financial goals.

Moreover, collaboration with monetary advisors and professionals can boost monetary preparation by using beneficial understandings, sector expertise, and customized methods tailored to certain try this website economic goals and circumstances. By incorporating sophisticated devices, automation, AI, and expert recommendations, individuals and services can boost their monetary preparation abilities and make informed choices to secure their financial future.

Final Thought

In verdict, the wise financing calculator solution offers various benefits and features for simplifying financial estimations - home loan calculator. By using this device, customers can easily determine loan payments, rates of interest, and settlement schedules with accuracy and performance. The automated computations provided by the calculator enhance economic planning and decision-making processes, ultimately causing better financial monitoring and educated choices

The smart car loan calculator remedy is designed to streamline your economic computations, offering a smooth means to evaluate and intend your lendings. On the whole, the advantages of automated estimations in streamlining economic procedures are undeniable, using increased accuracy, efficiency, and uniformity in complicated economic computations.

By utilizing advanced economic preparation software program and businesses, people and calculators can get much deeper insights right into their economic health, set reasonable goals, and establish actionable plans to attain them. AI-powered tools can offer individualized financial recommendations, recognize patterns, and suggest optimum financial investment opportunities based on private threat profiles and financial goals.

Report this page